Unum is a leader in critical illness insurance, offering enhanced coverage options and support services. Their payout chart PDF helps policyholders understand benefits and plan effectively for financial protection during serious health events, ensuring peace of mind for employees and their families.

1.1 Overview of Unum and Its Critical Illness Products

Unum is a leading provider of critical illness insurance, offering comprehensive coverage to protect employees and their families from financial hardships due to serious health events. Their critical illness products provide lump-sum payouts upon diagnosis of covered conditions, such as cancer, heart attacks, or strokes. Unum has recently enhanced its offerings, including improved coverage options and support services like the BestDoctors HRT program. These enhancements aim to deliver more value and flexibility, ensuring policyholders receive timely and adequate financial support during challenging times. Unum’s commitment to innovation and customer care makes its critical illness insurance a trusted choice for many.

1.2 Importance of Critical Illness Insurance

Critical illness insurance is essential for protecting individuals from financial ruin due to severe health conditions. Medical expenses, lost income, and lifestyle adjustments can strain finances, making recovery more stressful. Unum’s critical illness insurance provides a financial safety net, offering lump-sum payouts to help cover these costs. With the rising prevalence of conditions like cardiovascular disease, having such coverage ensures peace of mind. The payout chart PDF by Unum simplifies understanding of benefits, helping policyholders prepare for unexpected health crises and maintain financial stability during recovery.

1.3 Purpose of the Payout Chart PDF

The Unum Critical Illness Payout Chart PDF serves as a clear guide for policyholders to understand their benefits. It outlines the payout structures, conditions, and amounts for various critical illnesses, ensuring transparency. This document helps individuals assess their coverage needs and make informed decisions. By detailing how payouts are triggered and calculated, the chart empowers users to plan effectively for potential health crises. Regular updates ensure the information remains relevant, reflecting changes in policy terms and industry standards, making it an indispensable resource for financial planning and peace of mind.

Understanding the Unum Critical Illness Payout Chart

The Unum Critical Illness Payout Chart provides a clear overview of benefit payouts for various conditions, helping policyholders understand their coverage and plan effectively for health-related expenses.

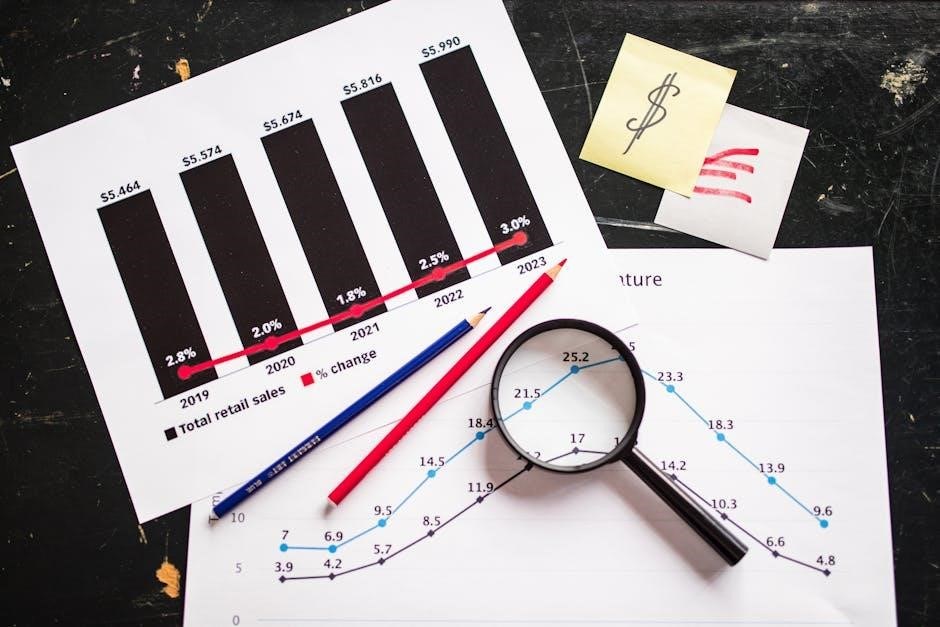

2.1 Structure and Layout of the Payout Chart

The Unum Critical Illness Payout Chart is designed to be user-friendly, with clear sections and tables that outline coverage details. It typically includes columns for specific illnesses, payout percentages, and conditions. The chart is organized to help policyholders quickly identify how much they could receive based on their diagnosis. Visual elements like tables and charts make the information easy to digest. The layout ensures that key features, such as coverage levels and payout triggers, are prominently displayed. This structure allows users to compare options and understand their benefits at a glance, making it an essential tool for financial planning;

2.2 How to Read and Interpret the Chart

To effectively use the Unum Critical Illness Payout Chart, start by reviewing the index or legend to understand the layout. Identify the specific illness or condition you’re interested in, then locate the corresponding payout percentage. Pay attention to any conditions or requirements listed, as these may affect eligibility. Use the tables to compare coverage levels and payouts for different scenarios. Cross-reference the terms and definitions section to ensure clarity. By systematically analyzing each section, you can accurately interpret the chart and make informed decisions about your coverage needs.

2.3 Key Terms and Definitions

Understanding key terms is essential for interpreting the Unum Critical Illness Payout Chart. Critical Illness refers to severe health conditions like cancer or heart attacks. Payout Percentage indicates the portion of the benefit paid upon diagnosis. Severity-Based Payments vary depending on the illness’s seriousness. Waiting Period is the time before payouts begin. Maximum Benefit Amount caps the total payout. These definitions help users navigate the chart effectively, ensuring clarity on what each term means and how it impacts their coverage and benefits.

Benefits of Unum Critical Illness Insurance

Unum’s critical illness insurance offers financial protection, flexible coverage options, and enhanced features like expanded services and improved policy management, providing a comprehensive safety net for policyholders.

3.1 Financial Protection for Critical Illnesses

Unum’s critical illness insurance provides a financial safety net for policyholders diagnosed with severe illnesses like cancer, heart attacks, or strokes. The payout chart PDF outlines the lump-sum benefits paid upon diagnosis, helping cover medical bills, daily expenses, or lost income. This financial support ensures policyholders can focus on recovery without added stress. Enhanced features, such as access to Best Doctors services, further bolster the protection, offering comprehensive care and resources during challenging times. Unum’s offerings are designed to alleviate financial burdens, providing peace of mind for employees and their families.

3.2 Flexibility in Coverage Options

Unum’s critical illness insurance offers adaptable coverage options to meet diverse needs. Policyholders can choose from various levels of protection, ensuring affordability and tailored financial security. The payout chart PDF details how benefits are structured, allowing individuals to select coverage that aligns with their life stage and financial situation. Enhanced features, such as optional riders and flexible payment terms, further customize the policies. This adaptability ensures that Unum’s critical illness insurance remains relevant and effective for policyholders facing different challenges, providing peace of mind through personalized protection.

3.3 Additional Features and Enhancements

Unum’s critical illness insurance includes enhanced features like the BestDoctors HRT service, offering comprehensive medical support. Policyholders also benefit from improved coverage options, such as life stage events, providing increased protection at affordable rates. Technological advancements in policy management enable easier tracking and adjustments. These enhancements ensure policies remain relevant and effective, addressing evolving needs. The payout chart PDF outlines these features, helping policyholders understand how they can maximize their benefits. Such additions underscore Unum’s commitment to providing robust, adaptable, and user-friendly critical illness insurance solutions.

How to Use the Payout Chart for Planning

The Unum critical illness payout chart PDF helps assess financial needs, determine coverage levels, and understand payout triggers, aiding in effective financial planning for critical illnesses.

4.1 Assessing Your Financial Needs

Evaluating your financial situation is crucial when planning with the Unum Critical Illness Payout Chart PDF. Consider your income, expenses, debts, and future goals to determine how a critical illness might impact your finances. Unum’s enhanced coverage options and support services aim to protect against unexpected medical costs and daily living expenses. By understanding your financial vulnerabilities, you can align your coverage with potential payout triggers, ensuring adequate protection. This step helps you make informed decisions about coverage levels and policy terms, safeguarding your financial stability during challenging times.

4.2 Determining the Right Coverage Level

Using the Unum Critical Illness Payout Chart PDF, you can identify the coverage level that aligns with your financial obligations and income. Consider your mortgage, debts, and daily living expenses to estimate the necessary payout amount. Unum’s enhanced coverage options allow you to tailor your policy to your needs, ensuring you’re prepared for potential medical costs. By reviewing the payout chart, you can determine how different coverage levels correspond to specific illnesses or conditions, helping you make informed decisions about your financial protection and peace of mind during challenging times.

4.3 Understanding Payout Triggers and Conditions

The Unum Critical Illness Payout Chart PDF outlines specific payout triggers, such as the severity of an illness or condition, and the terms under which benefits are released. Understanding these triggers is crucial for planning, as payouts may vary based on the diagnosis or medical requirements. For example, certain conditions like cardiovascular diseases or life-threatening cancers may have predefined payout percentages. The chart also details any waiting periods or documentation needed to activate payouts. By reviewing these conditions, you can better align your coverage with potential health risks and ensure you’re prepared for unexpected medical expenses. This clarity helps in making informed decisions about your financial security.

Factors Affecting Payout Amounts

Factors affecting payout amounts include the severity of the illness, policy terms, and inflation adjustments, as detailed in the Unum Critical Illness Payout Chart PDF, aiding financial planning.

5.1 Severity of Illness or Condition

The severity of an illness or condition significantly impacts Unum critical illness payouts. The payout chart PDF categorizes conditions based on their severity, with more severe cases qualifying for higher payouts. For example, a heart attack or cancer diagnosis may receive full benefits, while less severe conditions might offer partial payouts. Unum’s enhanced support services, like the BestDoctors HRT program, help assess the severity and ensure accurate payouts. This tiered approach ensures policyholders receive appropriate financial support based on their medical needs, aligning payouts with the level of care required.

5.2 Policy Terms and Conditions

Unum’s critical illness insurance payouts are governed by specific policy terms and conditions outlined in the payout chart PDF. These terms define eligibility criteria, coverage limits, and payout triggers. For instance, certain conditions may require a waiting period or meet specific severity thresholds to qualify for benefits. The chart also details exclusions and limitations, ensuring transparency for policyholders. Understanding these terms is crucial for determining how benefits are applied and what scenarios may affect payout amounts. Unum’s enhancements, such as improved coverage options and extended temporary cover provisions, are also reflected in these terms, providing clarity for policyholders.

5.3 Inflation and Cost of Living Adjustments

Unum’s critical illness insurance policies may include provisions for inflation and cost of living adjustments, ensuring benefits keep pace with rising expenses. The payout chart PDF outlines how these adjustments are applied, often through annual increases or percentage-based boosts tied to inflation indices. Such features help maintain the purchasing power of payouts over time, especially for long-term illnesses. Unum’s enhancements, like improved coverage options and extended temporary cover, further support policyholders in managing financial pressures. These adjustments are designed to provide a safety net that evolves with economic changes, offering added security for policyholders facing critical health events.

Unum’s Approach to Critical Illness Claims

Unum prioritizes a streamlined, efficient claims process, ensuring transparency and timely payouts. Their enhanced support services, including Best Doctors, provide policyholders with comprehensive assistance during critical health events.

6.1 Claims Process Overview

The claims process for Unum’s critical illness insurance is designed to be straightforward and efficient. Policyholders can initiate a claim by submitting required documentation, such as medical records and a claim form, through various channels, including online or by mail. Unum’s dedicated support team guides individuals through the process, ensuring clarity and reducing delays. The payout chart PDF serves as a valuable resource, outlining the benefits and conditions for payouts, helping policyholders understand what to expect. Unum prioritizes timely and fair claims resolution, aiming to provide financial support when it’s needed most, aligning with their commitment to protecting employees’ well-being.

6.2 Requirements for Filing a Claim

Filing a claim with Unum requires specific documentation to ensure a smooth process. Policyholders must submit a completed claim form, which can be accessed online or through their employer. Medical records confirming the diagnosis of a covered critical illness are essential. Additionally, proof of policy ownership and verification of the policy’s active status at the time of diagnosis are needed. The payout chart PDF outlines these requirements, helping policyholders prepare and understand what is needed for a successful claim submission. Unum’s support team is available to assist with any questions or concerns during this process.

6.3 Timeliness and Efficiency in Payouts

Unum prioritizes timely and efficient payouts to ensure policyholders receive financial support when needed most. The payout chart PDF provides clear guidelines on payout timelines, helping policyholders understand when to expect payments. Unum’s streamlined claims process minimizes delays, with dedicated support teams ensuring quick resolution of issues. Enhanced digital tools and improved communication channels further accelerate the payout process, offering peace of mind during challenging times. Unum’s commitment to efficiency ensures that critical illness benefits are delivered promptly, aligning with the company’s mission to provide reliable financial protection.

Enhancements to Unum’s Critical Illness Products

Unum has enhanced its critical illness products with improved coverage options, additional support services, and a redesigned product offering greater affordability and protection during life stage events.

7.1 Improved Coverage Options

Unum has introduced enhanced critical illness coverage options, offering more flexibility and affordability. Their redesigned products provide access to greater coverage during life stage events, ensuring policyholders can adapt to changing needs. The payout chart PDF reflects these improvements, detailing how benefits align with various health scenarios. Enhanced automatic entry limits and extended temporary cover provisions further strengthen financial protection. These updates aim to provide comprehensive support, making critical illness insurance more accessible and tailored to individual circumstances, as highlighted in recent product announcements and customer testimonials.

7.2 Enhanced Support Services

Unum has enhanced its support services to better assist policyholders. The BestDoctors HRT service now offers more comprehensive resources, providing expert medical guidance. Additionally, Unum’s learning center helps brokers and employers navigate benefits changes. These improvements ensure policyholders receive tailored support, from claim filing to understanding coverage. Enhanced services also include educational tools, empowering users to make informed decisions. The payout chart PDF complements these resources, offering clear insights into benefit structures. Together, these enhancements create a robust support system, ensuring policyholders are well-equipped to manage their critical illness coverage effectively.

7.3 Technological Advancements in Policy Management

Unum has introduced technological advancements to streamline policy management. The redesigned critical illness product includes digital tools for easier access to coverage details. The payout chart PDF is now integrated with online platforms, allowing policyholders to view and manage their benefits seamlessly. These innovations enhance user experience, providing real-time updates and personalized insights. Additionally, Unum’s website on healthcare reform offers resources to help brokers and employers stay informed. These technological improvements ensure efficient policy management, making it easier for policyholders to navigate their critical illness coverage and make informed decisions.

Real-Life Examples and Testimonials

Unum’s critical illness insurance has helped policyholders like Chriseta Gaskin and David Conner, who faced severe injuries and illnesses. Their stories highlight how the payout chart PDF provided clarity on benefits, enabling them to navigate financial challenges effectively and focus on recovery.

8.1 Case Studies of Policyholders

Unum’s critical illness insurance has provided vital financial support to numerous policyholders facing serious health challenges. For instance, Chriseta Gaskin and David Conner, though strangers, both experienced sudden inability to work due to injuries. Their stories, featured in Unum’s video testimonials, highlight how critical illness benefits helped them navigate unexpected medical expenses and recovery periods. These real-life examples demonstrate the practical impact of Unum’s coverage, emphasizing the importance of the payout chart PDF in helping policyholders understand their benefits and plan effectively for unforeseen health crises.

8.2 Customer Experiences with Payouts

Policyholders have shared positive experiences with Unum’s critical illness payouts, emphasizing timely support during stressful health events. Enhanced features like the BestDoctors service and improved coverage options have streamlined the claims process, ensuring financial relief when needed most. Customers appreciate the clarity provided by the payout chart PDF, which helps them understand their benefits and plan accordingly. Testimonials highlight how these payouts have covered medical expenses, allowing individuals to focus on recovery rather than financial strain, underscoring the practical value of Unum’s critical illness insurance.

8.3 Impact of Unum’s Critical Illness Insurance

Unum’s critical illness insurance has significantly impacted policyholders by providing financial stability during health crises. The payout chart PDF ensures clarity, helping individuals understand their benefits and plan effectively. Enhanced features like the BestDoctors service and improved coverage options have further strengthened the product. Customers report that payouts have covered medical expenses, allowing them to focus on recovery without financial strain. This support has enabled many to return to work and maintain their quality of life, demonstrating the profound impact of Unum’s insurance on both individuals and families during challenging times.

Comparing Unum to Other Providers

Unum stands out for its comprehensive critical illness coverage, enhanced support services, and flexible options, offering robust benefits and clarity through its payout chart PDF compared to others.

9.1 Unique Features of Unum’s Products

Unum’s critical illness insurance stands out with enhanced coverage options, such as improved automatic entry limits and temporary cover provisions. Their BestDoctors service provides comprehensive medical support, while the Benni system offers flexible workplace benefits. The payout chart PDF ensures transparency, detailing benefits clearly. Unum also addresses evolving needs with life-stage events coverage, making policies adaptable and affordable. These features, combined with a focus on cardiovascular disease prevalence, highlight Unum’s commitment to tailored, robust protection for employees and their families, setting them apart in the market.

9.2 Industry Standards and Benchmarks

Unum’s critical illness insurance aligns with industry standards, offering comprehensive coverage and transparent payout structures. Their products meet benchmarks for clarity and accessibility, as seen in the detailed payout chart PDF. Unum also exceeds expectations by providing enhanced support services and innovative features like BestDoctors. The company’s focus on cardiovascular disease prevalence and timely payouts reflects broader market priorities. By adhering to these standards, Unum ensures policyholders receive reliable, high-quality protection, maintaining its reputation as a leader in the critical illness insurance market.

9.3 Cost and Value Analysis

Unum’s critical illness insurance offers a balance of cost and value, with premiums structured to provide comprehensive coverage at competitive rates. The payout chart PDF helps policyholders assess the financial benefits, ensuring transparency in understanding what they receive for their investment. Unum’s enhanced features, such as BestDoctors, add significant value without excessive cost. Compared to industry benchmarks, Unum’s products are priced affordably while offering robust protection, making them a cost-effective choice for those seeking critical illness coverage. This balance of affordability and comprehensive benefits positions Unum as a leader in the market.

Staying Informed About Unum’s Offerings

Unum provides regular updates to the payout chart PDF, ensuring policyholders stay informed about coverage options and enhancements. Their learning center and customer support offer additional resources for understanding benefits and planning effectively.

10.1 Regular Updates to the Payout Chart

Unum regularly updates its critical illness payout chart PDF to reflect changes in coverage options, policy enhancements, and industry trends. These updates ensure policyholders have access to the most accurate and relevant information. The chart is revised to incorporate new features, such as expanded coverage for emerging illnesses or improved support services. Policyholders are encouraged to check Unum’s official website or contact customer support for the latest version. Regular updates help individuals make informed decisions about their financial protection and ensure they are prepared for potential health-related expenses.

10.2 Subscribing to Unum’s Resources

Subscribing to Unum’s resources provides policyholders with access to updated materials, including the critical illness payout chart PDF. Unum offers email newsletters, webinars, and educational tools to keep policyholders informed about product enhancements and industry trends. By subscribing, individuals can stay updated on changes to coverage options, payout structures, and support services. This ensures they are well-informed to make decisions about their financial protection. Unum also provides a learning center and customer support to help policyholders navigate their benefits effectively. Staying connected through these resources empowers individuals to maximize their coverage and plan for the future confidently.

10.3 Engaging with Unum’s Customer Support

Engaging with Unum’s customer support provides policyholders with personalized assistance in understanding their critical illness insurance and the payout chart PDF. Unum offers multiple channels for support, including phone, email, and online chat. Their team is available to address questions about coverage, claims, and payout structures. Additionally, Unum’s learning center and dedicated specialists help policyholders navigate complex topics. By engaging with customer support, individuals can ensure they fully understand their benefits and make informed decisions. This direct access to expertise enhances the overall experience and provides peace of mind for policyholders.

Future Trends in Critical Illness Insurance

Unum is committed to innovation, expanding critical illness coverage to address evolving health risks and financial needs, ensuring the payout chart PDF remains a vital planning tool.

11.1 Evolving Needs of Policyholders

Policyholders increasingly seek comprehensive coverage that adapts to life changes and medical advancements. Unum’s critical illness insurance evolves to address these needs, offering enhanced benefits like expanded BestDoctors services and flexible coverage options. With rising healthcare costs and growing awareness of critical illnesses, policyholders demand more tailored solutions. Unum’s updates, such as improved automatic entry limits and temporary cover provisions, reflect this shift. The payout chart PDF plays a key role in helping policyholders understand and plan for their evolving financial protection needs, ensuring they remain prepared for unexpected medical events.

11.2 Innovations in Product Design

Unum continuously innovates its critical illness insurance products to meet modern demands. Recent enhancements include expanded BestDoctors services, offering policyholders access to expert medical consultations. Additionally, Unum has introduced new products with life-stage event options, providing adjustable coverage at affordable rates. These innovations aim to deliver more personalized and flexible solutions, addressing the diverse needs of policyholders. The payout chart PDF reflects these updates, ensuring clarity and transparency in benefit structures. By integrating technological advancements and customer feedback, Unum remains at the forefront of critical illness insurance design, offering robust and adaptable protection for policyholders.

11.3 Regulatory Changes and Compliance

Unum stays ahead of regulatory changes, ensuring its critical illness insurance products comply with industry standards. The company regularly updates its policies to align with evolving legal requirements, such as data privacy laws and transparency mandates. Unum’s payout chart PDF is designed to meet these compliance standards, providing clear and accessible information to policyholders. By adhering to regulatory guidelines, Unum maintains trust and accountability, ensuring its products remain relevant and secure. This commitment to compliance underscores Unum’s dedication to delivering reliable and ethical critical illness insurance solutions in an ever-changing legal landscape.

Unum’s critical illness insurance, supported by its payout chart PDF, offers vital financial protection and peace of mind. Regular updates and enhancements ensure relevance and value, encouraging informed planning for unforeseen medical events.

12.1 Summary of Key Points

Unum’s critical illness insurance provides financial protection during serious health events, offering enhanced coverage options and support services. The payout chart PDF is a vital tool for understanding benefits and planning. It outlines payout structures, terms, and conditions, ensuring policyholders are informed. Regular updates and improvements, such as extended temporary cover and automatic entry limits, reflect Unum’s commitment to meeting policyholders’ needs. The chart helps assess financial requirements and determine appropriate coverage levels, emphasizing the importance of preparedness for unforeseen medical challenges. Staying informed through Unum’s resources ensures policyholders maximize their benefits and financial security.

12.2 Final Thoughts on the Importance of Planning

Planning is crucial for financial stability during critical illnesses. Unum’s payout chart PDF provides clarity on coverage, helping individuals prepare for unexpected medical events. By understanding payout structures and terms, policyholders can make informed decisions. Regular updates and enhancements to Unum’s products ensure relevance and adaptability to evolving needs. Proactive planning with Unum’s resources empowers individuals to secure their financial future, reducing stress during challenging times. Staying informed and reviewing the payout chart regularly is essential for maximizing benefits and ensuring peace of mind.

12.3 Encouragement to Review the Payout Chart

Reviewing the Unum critical illness payout chart PDF is essential for understanding your coverage and ensuring financial preparedness. It provides clear insights into payout structures, helping you make informed decisions. Regular updates and enhancements, such as improved coverage options and support services, are highlighted in the chart. With the prevalence of severe injuries and illnesses, having adequate coverage is crucial. Take the time to familiarize yourself with the chart to maximize your benefits and secure your financial future. Stay proactive and informed to make the most of Unum’s critical illness insurance offerings.